What does tax-free mean and what is its use in traveling? This is the question of many travelers. Many travelers do not know tax-free. Tax-Free is exempt from tax when shopping, which travelers and tourists can benefit from. There are no complicated rules on how tax-free includes tourists, and you need to know whether your destination country is a member of the tax-free law or not. If so, you should go to shops that implement this law when shopping. In this article from Eligasht, we will talk about tax-free and the rules governing it. If you want to use it tax-free in your travels, stay with us until the end of the article.

Book Iran Air flights from London to Tehran and Tehran to London with Eligasht UK:

What is the use of tax-free?

What is the use of tax-free is the question of many users. First of all, to answer this question, we have to tell you that in many countries, goods have value-added tax and you pay the goods tax when you buy. For example, the value-added tax on cosmetics and electronics is about 18%, which is a significant amount, and in order not to pay this amount, you must benefit from the tax-free law. The use of tax-free is to exempt you from value-added tax and is one of the simplest ways to reduce travel costs.

Shopping is one of the entertainments that make travelers happy, and now if they benefit from the tax-free law, the pleasure of shopping will double for them. So when you travel to the destination country, you should check if this country has tax-free laws and if you can benefit from them. In the next paragraph, we have prepared a list of all the countries that use the VAT exemption law for tourists so that you, the traveling audience, can travel easily.

Related post

Introducing the most popular tax-free shops in Asia

23 of the World’s Weirdest Airports

10 Biggest Airports in the World

Countries where tax-free laws apply

About fifty-five countries in the world use the VAT-exempt law for tourists. The countries where tax-free laws are implemented include Australia, Austria, Azerbaijan, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Indonesia, Ireland, Israel, Mexico, Morocco, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Singapore, Argentina, Armenia, Slovenia, Slovakia, Spain, South Africa, Sweden, Switzerland, Taiwan, Thailand, Turkey, England, Italy, Japan, Korea, Latvia, Lebanon, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malaysia, the United States, and Vietnam. You do not pay VAT when shopping in these countries, and you can easily cover your travel expenses. you reduce

The value added to each product is different and its percentage is also different. You should also be careful that the laws of value-added tax on products are different in each country. For example, if a product has a 4% value-added tax, you may not want to use it tax-free. For this reason, read the value-added tax equivalent of any product you buy and then proceed to purchase. It is very suitable for goods that have a high value-added tax on the goods and remember that the tax-free law only includes tourists in the mentioned countries.

In which centers should we shop to benefit from the tax-free law?

Well, one of the basic questions of tourists in the field of tax-free is, which centers should we shop from to benefit from the tax-free law? According to the list of countries exempt from VAT for tourists, pay attention to each one. If you travel from these countries, in several shops or shopping malls, there is a tax-exempt sign on the glass of the shop, or it is written above the entrance door of the shop or above the shopping box, when you see it, enter the shop. Be desired and start shopping. Of course, the shop assistant will also check your passport.

It is good to show your passport at the beginning and end of the purchase. This is the easiest way to purchase or VAT exempted goods. So don’t leave your passport while traveling and shopping. Each person with his passport has the possibility to benefit from the tax-free law and the cost of family trips is significantly reduced. For example, if you have a young child and you want to buy for him, then take his passport with you when shopping and don’t forget it in duty-free shops. Most of the shops in the touristic cities of Turkey such as Istanbul, Kuşadası, Izmir, Ankara, and Antalya have such laws and you can benefit from this service and have a significant reduction in your travel expenses.

How and where to receive tax-free fees in the destination country?

Maybe the tax-free shops are very hard to find and you can’t find them or there is only a handful of them. But we have to tell you that you can still use the tax-free law and receive the cost of your tax-free trip. Well, now the question arises for you, how and where to receive our tax-free fee? To get a tax-free fee for every purchase you make, you must receive an invoice from the seller for the goods exempt from value-added tax. All invoices must have beads. It is good to keep all the stamped invoices of the buyers in the folder.

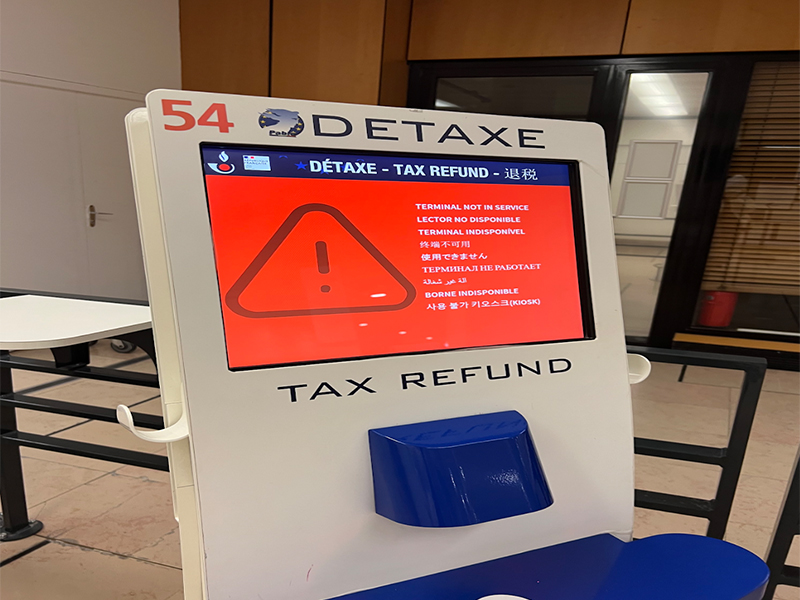

To find this fee, go to the customs counter at the airport when you return from your trip. You have to go to the airport a few hours earlier. Hand over the documents, invoices, and passports to the customs counter. Here you must also hand over your duty-free goods and luggage in a suitcase. After checking the goods and the invoices, the customs counter will re-stamp the invoices and deliver them to you.

Now you go to the exchange office at the airport and by presenting the documents, you will receive the tax-free fee for the goods. This method seems complicated for many travelers, but it usually takes one to two hours and you can easily receive tax-free money. You can only pay the tax fee at the airport, they do not have such services at the train station and passenger terminals.

Is there a limit to using the tax-free law?

Another question is, are there any restrictions on using the tax-free law? If we travel to the destination country two or three times, we can use this law again. Well, in response, we have to tell you that in the year and on your first trip to a destination country, you can receive a higher tax-free fee. Of course, remember that every country has its own rules. Even a number of countries have a tax-free limit.

You can read the tax exemption law of the destination country before your trip. It is better to search in English. Also, at the airport, ask the exchange office about the tax-free law and be informed that you can benefit from the tax-free law on the second and third trips in a year to the same country as the first time. Usually, the best place to learn about the tax-free rules is the airport exchange offices, because this department will pay your tax-free fee by presenting the documents and they are aware of the latest rules.

Advantages

The advantage of tax-free is that you don’t need to pay the high cost of the tax on goods. Travel costs will decrease, and apart from that, it will cause prosperity and expansion of the tourism industry. When tourists use such services, they travel more, and in fact, the income from tourists in general increases for each country. The countries that implement the tax-free law consider the huge benefit of the traveler entering their country.

Another advantage is that it allows travelers to purchase items that may not be available in their home country or region. By shopping , travelers have the opportunity to pick up unique souvenirs, clothing, cosmetics, or even luxury items that they would not normally be able to find back home.

In addition to these financial benefits, also provides a unique shopping experience that travelers may not have experienced before. By shopping in a tax-free shop, travelers can enjoy the thrill of finding great deals and picking up special items with the added excitement of saving money on their purchases.

What to Consider When Shopping

When shopping , it’s important to consider a few key factors to ensure that you’re making the best decisions for your purchases. Here are some things to keep in mind:

Tax Rates:

First, it’s important to understand the tax rates in the country where you’re making your purchase. Some countries have very high taxes on certain types of goods, such as alcohol, cigarettes, and luxury items. By shopping tax-free, you can avoid paying these taxes and make your purchases more affordable.

Eligible Goods:

Next, it’s important to make sure that the items you’re purchasing are eligible for tax-free shopping. Not all items are eligible, so it’s important to check with the relevant authorities to ensure that your purchases qualify. For example, in some countries, electronics and certain types of food items are not eligible for tax-free status.

Customs Regulations:

It’s also important to be aware of the customs regulations in the country where you’re making your purchase. In some countries, there are restrictions on the quantity and value of goods that can be taken out of the country. By being aware of these regulations, you can avoid any surprises at the customs checkpoint.

Refund Process:

Additionally, it’s important to understand the refund process for tax-free shopping. In some countries, the refund process is straightforward, while in others, it may require a bit of paperwork. By understanding the process, you can ensure that you receive your refund promptly.

Overall, when shopping tax-free, it’s important to be aware of the relevant tax rates, eligible goods, customs regulations, and refund process. By taking the time to research these factors, you can make informed purchasing decisions that save you money and avoid any surprises.

Final words

Tax-free is the law that exempts goods from value-added tax. About 55 countries use this law. It attracts more tourists and travelers can reduce their travel expenses with the tax-free law. To receive it, you can use it at the moment while shopping in the shops, or you can receive tax-free money at the airport by presenting documents.

Ultimately, the decision to shop in a tax-free shop is a personal one. However, for travelers who are looking to save money, pick up unique items, and enjoy a one-of-a-kind shopping experience, tax-free shopping is an excellent option. With a little planning and research, travelers can make the most out of their tax-free purchases and return home with some great souvenirs and memories.